We’ve all heard it. Millennials are stuck in rentals… forever. The American dream of owning a home will never be within a millennials reach. Or will it? The truth of the matter is there are ideas circulating we’ve been believing about home ownership and millenials that simply aren’t true.

Myth #1: I can’t find a better price for the space I rent

We can’t speak for other areas, but in the Cedar Rapids area, there is no comparison for price per square foot.

We can’t speak for other areas, but in the Cedar Rapids area, there is no comparison for price per square foot.

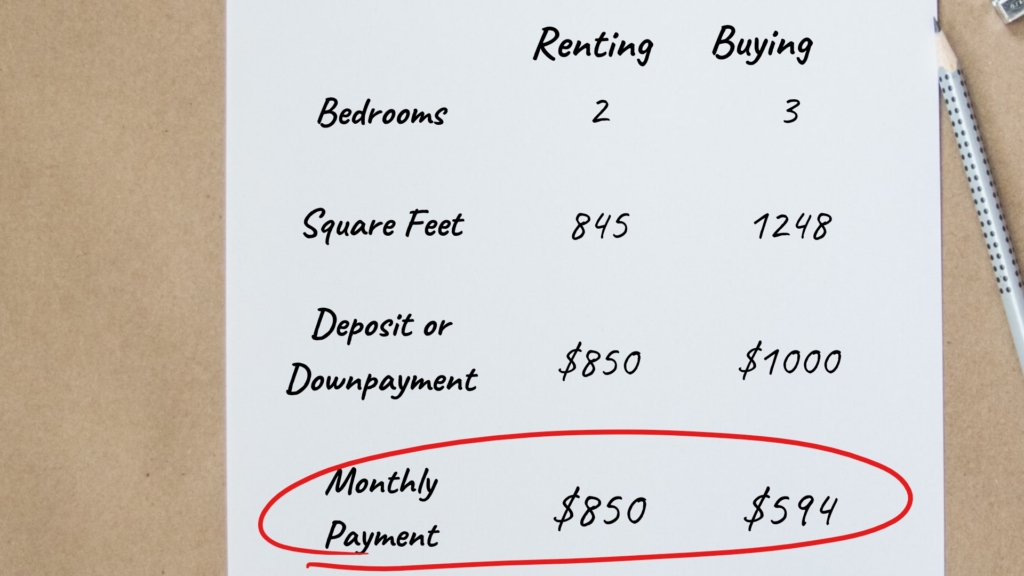

Lots of homes in the area are within your price range (even with student loan debt). Renting a home in Cedar Rapids is actually a costly endeavor. For a two bedroom apartment in a less than desirable area of town can run an average of $850/mo. When you break down the payments for a 3 bedroom home, the average is about $594/mo.!

We put together a quick comparison using two real life example houses. You can see for yourself owning a home is actually LESS per month with MORE room.

When you do the math, it’s far cheaper to invest in a home, rather than in a rental. We’ve seen it time and time again. There are times when you should rent (planning on moving, improving credit to purchase a home etc.) and there are times to buy. Right now in Cedar Rapids, it’s a great time to buy instead of rent.

Myth #2: I don’t have time to maintain a home

Most of us are busy. Work, social events, and possibly children are major time commitments. On average, a person will spend 3-7 hours a month repairing, improving or maintaining their home (not including those who like to landscape and garden).

Most of us are busy. Work, social events, and possibly children are major time commitments. On average, a person will spend 3-7 hours a month repairing, improving or maintaining their home (not including those who like to landscape and garden).

Something to consider would be how much is your time worth to you? With the savings you made on buying instead of renting, is the time you spend worth the savings?

Myth #3: I can’t find a “move in ready” house I can afford

Most places do need your touch. Otherwise it wouldn’t be yours. Thankfully, most homes need only cosmetic changes. Paint, carpet and decorations really make a huge difference in making a home feel like your own. You can even write into your offer you’d like a discount for improvements.

An average room of paint runs about $200. Home Goods has throw pillows with personality to help you make that house a home for $25 a piece. Or you can try finding wall art at the spring garage sales. It’s within your grasp, you just need the right perspective.

Don’t give up on the home that fits your family, just because it has pepto bismol pink walls. And as for that shag carpet- just wait for that trend to come back around, it won’t be long.

Myth #4: Renting is the safer financial choice

Renting does save you from a few things. When the water heater breaks, it’s not your problem. However, we view home ownership as a long term investment (as does the rest of the world), and so you may not see the rewards as soon as you’d like.

Here’s what Dave Ramsey has to say about home ownership. “Owning your home outright is a huge part of achieving financial peace.

As long as you can continue to pay the taxes and insurance on your property, you don’t have to worry about ever losing your home. Eliminating that risk not only gives you peace of mind regardless of the ups and downs of the real estate market, but it also frees up your budget to start saving for other types of investments.”

In a market where housing seems to fluctuate majorly from decade to decade, the safest bet would be to pay off a home. When it’s yours, it’s yours.

What did you think? Did we miss any myths you’ve heard floating around? Leave a comment!